Fighting FAFSA Fears

Lili Jones | February 8, 2024

Financial Aid is on the minds of college students across the United States. Whether students are looking for loans, scholarships or grants, they should be aware that the 2024/25 Free Application for Federal Student Aid (FAFSA) form is going through serious changes from years prior.

According to the Federal Student Aid website, the FAFSA Simplification Act has significantly overhauled the processes and systems used to award federal student aid with a goal of increased transparency, inclusivity and simplicity for students. Despite the aims of making the FAFSA more straightforward and accessible to students, many have been confused by constantly changing deadlines and crashing websites.

In years past, the FAFSA form has opened on Oct. 1 each year with students’ “expected family contribution” (EFC) and aid packages being sent to colleges in late January or early February. However the 2024-25 FAFSA did not open until Dec. 30, and then almost immediately crashed half an hour later. The form is currently open 24/7, but the confusing language from the US Department of Education (ED) has made it seem as though schools may not begin receiving student information until early March.

“To further support schools and state agencies, the Department will begin transmitting batches of FAFSA information—known as the Institutional Student Information Record or ISIR—to these partners in the first half of March. Students will also be able to make corrections to their form starting in the first half of March,” wrote a Jan. 30 press release from the ED.

So how is one meant to complete the FAFSA without losing their mind? Luckily, the form itself is not quite as confusing as the buzz around it.

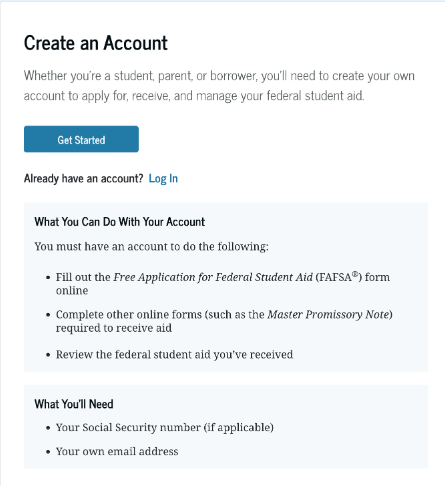

First, students must create an account on Studentaid.gov called an FSA ID. With little exception, a social security number (SSN) is required to create this account since the FAFSA form draws tax information directly from the Internal Revenue Service (IRS).

Then, the student can select up to 20 schools to send the FAFSA results to: now in the form of an index number from -1500 to 999999 called the Student Aid Index (SAI), rather than an Expected Family Contribution, which was a dollar amount.

If a student is dependent on others for financial support, contributors must also create a Studentaid.gov account, though their SSN is not required. Any person who provides financial aid to the student, such as parents/legal guardians and their spouses, as well as student spouses, can be considered contributors. To invite contributors to the FAFSA, students must provide that individual’s first and last name, SSN (if applicable), email address, and date of birth.

One major difference with the 2024-25 FAFSA is an option to indicate unequal support from divorced parents. If a student’s parents are divorced, then the parent who provided more financial support over the past 12 months (if unequal financial support) or the parent with a greater income and assets (if equal financial support) should be listed as a contributor.

Once students and contributors have an FSA ID, they must consent to have their federal tax information transferred directly from the IRS to the FAFSA- another new addition to the 2024-25 form. This step is now required to be eligible for federal student aid, even if students and contributors do not have a SSN, and/or did not file a tax return.

The 2024-25 FAFSA form, confusingly, requires 2022 tax information. If that information does not represent a student’s current financial need—for example, a parent lost their job in 2023 and can not contribute as much as before— they can reach out directly to colleges and institutions to explain the change in income.

After students provide contributor information, they must provide their own information, including their assets and dates of legal residence in their state. Students should have their bank information and checking and savings accounts on hand to record on the form. They can also choose to provide information about their race, ethnicity, gender identity, and whether their parents graduated from college.

Finally, students and contributors both must sign and submit the FAFSA form after accepting the terms and conditions. If the form is not signed and submitted, the information will not be shared with schools. The 2024-25 FAFSA will close on June 30, 2024, though many colleges require financial aid information before this date.

Studentaid.gov provides many resources on their website that can help students with the process of filling out the 2024-25 FAFSA form. This new form, despite the regrettable fiasco that was its terrible debut, is far more inclusive to students in different financial situations than in years prior.

Like many aspects of the college admissions process and the everyday bureaucracy of higher education, the FAFSA form is all bark and no bite. It’s deceptively simple and, with the right information, it’s nothing to fear.